Extreme Inequality in Politics, Healthcare and Economics

CONTENTS OF THIS ARTICLE:

- How Big is the Wealth Divide? — Illustrated by a great video infographic

- The Corrupting Influence of Big Money in Politics — and how it threatens our democracy.

- “Saving Capitalism“ — Documentary & summary notes about extreme inequality, growing distrust of government, and the rise of Donald Trump

- “Inequality for All“ — Older documentary with additional insight

- Tax Reform Proposals

- Tax Debate — How much should we tax the rich?

- Bill Analysis — Trump’s Historic Republican Tax Bill

- Charts — Growth Doesn’t Trickle Down, It Rises Up

- TED Talk — “As taxes on the rich go up, job creation goes down.”

- Other Related Videos

- Related Articles (as I find them, followed by tons of comments)

How Big is the Wealth Divide?

Almost 80% of Americans now live paycheck to paycheck, and 40% say they would be unable to pay their bills if faced with a $400 emergency, according to a recent Federal Reserve survey. They’ve managed their debts so far, because interest rates have remained low. But the days of low rates are coming to an end.

“The underlying problem isn’t that Americans are living beyond their means. It’s that their means haven’t kept up with the growing economy. Most gains have gone to the top, along with political power that further tilts the playing field.” — Robert Reich, talking about extreme inequality as a likely cause of The Next [Economic] Crash.

In this first (4:36) video, mall shoppers learn just how extreme wealth distribution is – far more than they thought.

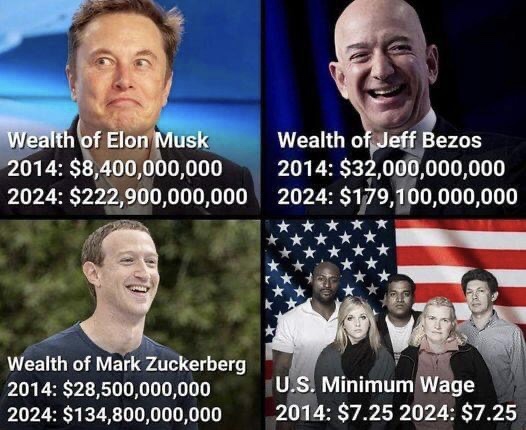

Shoppers in this next (1:36) video learn that the value of a penny to typical American households is the equivalent of $11,700 to Amazon CEO Jeff Bezos.

Corrupting Influence of Big Money in Politics

The problem with rising wealth and income inequality is that it leads to unequal political influence and opportunity as well, and that’s what threatens our democracy. To gain political influence, wealthy special interests have invested for decades and poured millions into conservative think tanks (Kato Institute, American Enterprise Institute, Heritage Foundation, Federalist Society, American Legislative Exchange Council) and media (AM talk radio, Fox News, One America News, NewsMax).

Conservatives and Progressives seem to have the same complaint — “I work hard, so why should some lazy asshole get all my money?” We just disagree on who the asshole is: the family on food stamps trying to get by, or the dude paying cash for a third mega yacht. The problem of extreme inequality, resulting in privilege and political corruption, lies beneath almost every issue our society faces today, including healthcare, immigration, infrastructure, the environment, women’s rights, social justice, foreign relations, and more. It’s also connected to 400 years of systemic racism, which is not covered here.

Older Video Infographic(6:23), highlights & updates

-

- While our Perception of wealth distribution is far from our Ideal, but it’s not even close to Actual distribution.

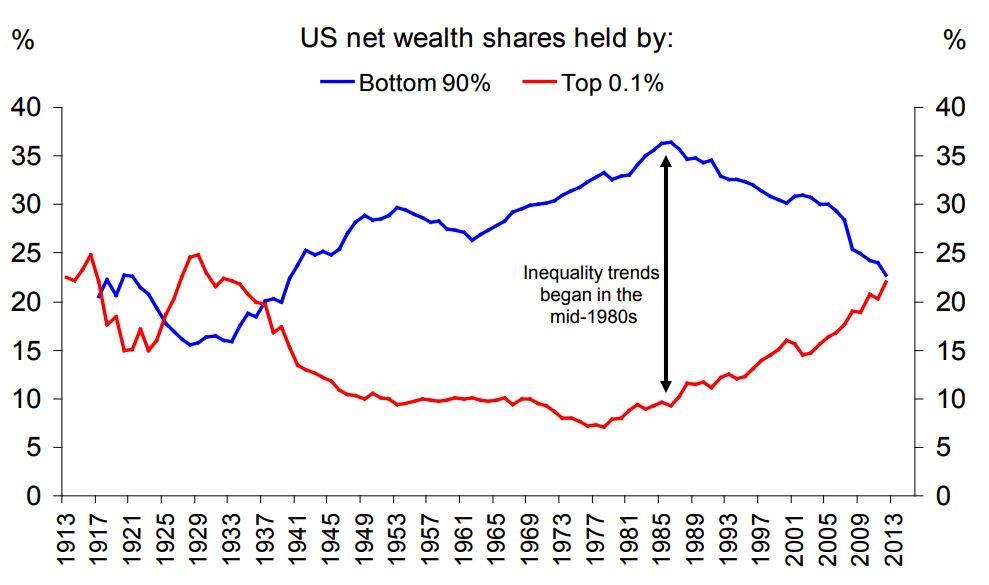

- The top 1% (now the top 0.1%) has more of the nation’s wealth than 90% of us think even the top 20% should have.

- The top 1% has 40% of all of the nation’s wealth and takes home almost 25% of the annual income. UPDATE (Nov.2017): The richest 1% now own more wealth than the bottom 90% combined (the entire middle class). That’s $34.73T versus $32.80T (Federal Reserve stats for 2Q2019).

- Each of the 400 richest Americans has on average *the same wealth* as over a million (1,308,400) working class adults. That’s roughly the population of Dallas. (Robert Reich, Oct.2019)

- America’s richest 400 families now pay a lower tax rate than the middle class. (CBS News, 10/17/2019)

- The top 1% own half the country’s stocks, bonds and mutual funds. UPDATE (Jan.2018): The top 1% grabbed 82% of all wealth created in 2017 (CNN Money). Actually, the top 1% own more corporate equity and mutual fund shares than the bottom 99% combined. That’s $13.73T versus $32.80T (Federal Reserve stats for 2Q2019).

- The three richest Americans ― Bill Gates, Jeff Bezos and Warren Buffett ― now have the wealth of the bottom half of the U.S. population, or 160 million Americans.

- The bottom 50% live hand-to-mouth and own less than 0.5% of stocks. They don’t invest.

- CEOs make about 380 times more than the average worker (not lowest, but average), but do they really do 380 times more work or contribute 380 times more? UPDATE (Nov.2015): CEOs now make almost 1,000 times more. While the video examines wealth of the top 1%, we should now be looking at the top 0.1% & 0.01%. And we should craft tax policies accordingly. But Congress instead gave huge tax cuts to the wealthy.

- The Average worker needs to work more than a Month (now >2 months) to make what the CEO makes in just one Hour.

- UPDATE: The 26 richest people on Earth now own as much as the 3.8 billion who form the poorer “half” of the planet’s population. That’s 26 people v. 3,800,000,000.

- Stop calling the wealthy elite, because they’re not batter than us. Instead, refer to them as the “predator” class, because people wealthy enough to buy college admission, rig the tax code to their benefit, and refuse others healthcare are predatory people

CEOs, who have a fiduciary responsibility to serve the investment interests of shareholders above almost all else, have seen their compensation tied to quarterly stock prices. They now make more personally from stock buy-backs and investments in political influence than from investing in Research & Development. Their compensation packages encourage short-term decision making, and they’ve learned that it’s easier to increase profits by cutting expenses (mostly wages) than by innovating and expanding markets.

Saving Capitalism (2017 documentary)

“SAVING CAPITALISM“ is about extreme inequality, the growing distrust of our political system, and the rise of Donald Trump. Watch the 2-minute trailer with my notes from the full version (on Netflix). I highly recommend it no matter your party affiliation.

TRUMP TAX CUTS: At almost the same time the film came out, House Republicans voted to hand tax breaks to billionaires at the expense of healthcare and the middle class. The bill widened the wealth gap even more and threatens democracy as we know it. (A Business Insider analysis of this bill is included toward the bottom of this article.)

Film Highlights

- Robert Reich has been in public service for 50 years. He is a Former Labor Secretary, serving under three presidential administrations — Ford (R), Carter (D) and Clinton (D). I find him eminently qualified to speak on labor issues, including inequality and taxation.

- Party Affiliation — Rather than labeling people as liberal or conservative, and putting them in blue tribes or red, Reich went around the country asking people what they thought about Politics, the Economy, and Values. He found that they had shared concerns with crony capitalism and the wealth “establishment.”

- Populism — Many of the people interviewed liked both Donald Trump and Bernie Sanders, because they both had a populist, anti-establishment message. But populism can go in two different directions. It can either go toward an authoritarian form of government (Trump), or fundamental democratic reform (Sanders).

- Capitalism — There’s no such thing as free market capitalism without rules governing Property, Monopoly, Contracts, and Bankruptcy. But who makes the rules? And who enforces them? When was the last time the Federal Trade Commission filed an anti-trust suit?

- Rigged System — Because of wide disparity of wealth, influence and opportunity, the laws and political systems have become rigged against all but the wealthy who buy influence. Meanwhile, public welfare has gone more to corporations that don’t need it, rather than poor people who do.

- Fear — People of both political parties are frightened, anxious and feel insecure about their future, but no one in a nation as rich as ours should be made to feel like that.

- Distrust of Government — According to recent surveys, our trust in government has plummeted from 77% in 1964 to 20% today (2017).

- Lost Voice — Our own influence has been drowned out by wealthy special interests that control much of the media and can now make unlimited campaign contributions in secret, thanks to the Roberts Supreme Court and its Citizens United decision.

- Lobbying — $3.15 Billion was spent on lobbying last year (2016). That amounts to a whopping $5.9 Million per member of Congress, and it buys a whole lot of influence.

UPDATE: The 2020 election cycle promises to be the most expensive ever. Windfalls from the Trump tax bill have proven that investing in political influence has extraordinarily high ROI. The Koch brothers alone saved between $1 billion and $1.5 billion with the Trump tax bill and reportedly plan to spend $400 million campaigning this election cycle. That’s in additional to their funding of conservative think tanks, opposition research, focus groups, and such. - Our Declining Influence — The preference of average Americans appears to have only a minuscule, near zero, statistically non-significant impact on public policy. Crony capitalism now has significantly more impact than your calls, emails, letters, and personal visits to elected officials. That’s because money buys TV, print and online advertising that gets unaware people to vote against their own best interest. (from research over a 20-year period from 1982-2002 by Northwestern and Princeton Universities)

- Counter-balance — For fundamental reform to succeed, it needs institutions that counter the wealthy special interests and conservative Think Tanks. We’ve seen examples of that already as people have gotten organized into movements such as Occupy Wall Street, The Women’s March, Indivisible, Black Lives Matter, and the $15/hour minimum wage movement.

- Millenials — Reich concluded by saying the task of saving capitalism is now up to the next generation. They’re already stepping up — to protest, or run for office themselves. We saw examples of that in Virginia, with a new wave of women and minority candidates running for office and winning, turning 15 red seats blue. And we saw it after the Parkland school shooting.

- Activism — To be a citizen activist, Reich says people should: (1) be patient and persistent, (2) talk to people who disagree, and (3) have some fun.

Additional Thoughts on Extreme Inequality

As I watched Saving Capitalism and took notes, I captured these additional thoughts:

- Violence — I wondered about the impact that fear, anxiety, insecurity, and record levels of distrust of government might be having on our rising rates of suicide and mass murder. They seem related.

- Free Speech — I also worried about the FCC’s plans to repeal Net Neutrality protections, and with earlier decisions to allow media companies to gain monopoly control of the news by combining TV, radio and print in any city. Without strong regulatory oversight and consumer protections, network operators will be able to filter the truth and determine what news we see, as well as limit how much impact our own voice has. That’s a direct threat to free speech. My interest in this is partly because of the important role that Internet access and broadband competition has on telemedicine and the future of healthcare.

Inequality for All

Inequality for All is an older documentary featuring Robert Reich. Filmed in 2013, it offers more expert insight. The film is described as “a game-changer” in our national discussion of extreme inequality, but only if people watch it. Please share this article on social media to encourage discussion among your friends and families.

After watching the trailer, you can also watch the full version. You may even want to host a Watch Party, inviting your friends and discussing the issues raised. It’s a great way to understand the impact inequality has had on our nation’s poor and middle-class, the economy in general, and our healthcare in particular.

Reich starts with a discussion of the big picture of extreme inequality, just how wide the wealth gap has become, and how billionaires with lavish lifestyles still have trouble even spending what they earn. They can only buy and manage so many homes, cars, pillows, jeans, or haircuts. Because of the difficulty spending such extreme wealth, their contribution to the economy and jobs is limited. Reich then describes some of the causes of the inequality, including:

- Globalization,

- The accelerating pace of tech innovation, and

- The growing influence of big money in politics,

- to which I’d add Privilege (watch the video in this article).

His recommendations are hard for some people to swallow, a bitter pill if you will, including:

- Get big money out of politics,

- Fix the tax system,

- Invest in education,

- Raise the minimum wage,

- Strengthen worker’s voices, and

- Reform Wall Street.

Tax Reform PROPOSALS

Here are some of my own proposals. Add your own in the comments below.

A Livable Minimum Wage of say $15/hour, adjusted for inflation. The bottom 50% of the population lives hand-to-mouth and don’t invest, because they spend all of what they earn on expenses. So, any extra money they get goes directly into the economy, creating increased market demand for goods and services that mostly benefit those at the top. Henry Ford understood that, as he paid workers more than the going rate and shortened the workday from nine hours to eight. And as David Gerrold said, “If we don’t guarantee even the most medial of workers a living wage, we’re not a free society, we’ve just changed the mechanics of slavery.”

A Maximum Wage of say 30 times higher than a company’s average worker, including executive wages, stock options, and all other forms of compensation to make it more difficult to “game” the system. An alternative could be lowering the tax burden of companies who keep a low ratio between the highest incomes and lowest.

A Maximum Wage of say 30 times higher than a company’s average worker, including executive wages, stock options, and all other forms of compensation to make it more difficult to “game” the system. An alternative could be lowering the tax burden of companies who keep a low ratio between the highest incomes and lowest.

Social Security – Raise or remove the cap on taxes collected, and close all tax loopholes. Also, repay what’s already owed to the Social Security trust fund ($2.8 trillion as of 2014).

Capital Gains taxed at the same rate as ordinary income, not just 15% as it is today. Capital Income from owning stuff (stock, rental property, bank loans) is highly concentrated among the wealthy and makes up about 30% of our nation’s total income. It continues to grow at a faster rate than labor income, which remains stagnant, but it’s currently taxed at a lower rate. That makes no sense since capital income largely comes without having to work for it. Watch “The Problem of Capital Income” below.

Inheritance Income should also be taxed at the same rate as ordinary income after a modest exemption of say $10M to protect family farms. As with capital income, it comes without working for it.

Wealth Tax (added Feb.2019) – Sen. Elizabeth Warren (D-MA) has proposed a wealth tax on multimillionaires and billionaires that is long overdue. The wealthiest have managed to extract more and more money for themselves by keeping wages down, by using novel investment strategies not available to the less wealthy and by legally manipulating stock prices, for instance, through share repurchases. The super wealthy can also live lavish lifestyles with no reportable income and so pay no income tax. That’s because they can borrow from accumulated wealth that continues to grow faster than they can spend.

Progressive Tax Reform – Replace Trump’s tax bill with a progressive tax plan that has more tax brackets and a top rate of 90%. Even with the widening income gap, Trump’s tax bill has just one bracket for both small businessmen and billionaires, taxing income above $415K at 35%. So without hurting 99% of the nation, we could generate considerably more revenue by adding additional brackets and taxing income above $2M/year at 50%, income above $20M at 65%, and income above $200M at 90%. Billionaires would only be taxed at the highest rate on the portion of income above $200M, so don’t look at this as a disincentive to work hard or invest, because it’s not.

Other Tax Reforms – What if We Actually Taxed the Rich? That’s the question Robert Reich asks in this 2-minute video from April 2021. He lists seven proposals:

- Repealing the Trump tax cuts would raise some $500 billion over 10 years.

- Raising the marginal tax rate by just 1% on those at the top would bring in $123 billion over 10 years.

- A wealth tax on the richest 0.1% would add $2.75 trillion in revenue over 10 years.

- A tiny 0.1% tax on financial transactions would raise $777 billion over 10 years.

- Ending the “stepped-up cost basis” capital gains loophole would bring in $105 billion.

- Closing other tax loopholes for the super-rich would raise $14 billion over a decade.

- Increasing the IRS’s funding so it can audit rich taxpayers would generate at least $1.75 trillion over the decade.

Together, these 7 ways of taxing the rich would generate more than $6 trillion over 10 years. But reforming our health care system would do even more. By matching the average per capita spending of other rich nations, we would save an estimated $2 trillion each year, not spread over a decade. It would also lead to a healthier and more productive workforce that would help increase corporate profits and national GDP. But of course, no one in Washington is talking about that.

In the above video, Michael Linden provides a clear description of Marginal Tax Rate, which is widely misunderstood, and misrepresented by many right-wing politicians. While I call for adding more tax brackets, to represent the widening income gap, Linden simplifies the concept with just three.

Note that I’m careful to not position progressive tax reform suggestions as punishment of the wealthy. That’s because we still need capitalistic incentives to encourage investment and risk-taking. It’s just that the proposals would improve tax fairness, sufficiency and efficiency. But the Republican tax bill, which was touted as a middle-class win but mostly benefited the wealthy, will reported save Trump’s family over $1.1 Billion, because it reduces or eliminates the estate tax. That’s not how “trickle-down” was supposed to work. Robert Reich explains the myth in this video and later wrote an essay telling us the inequality problem also includes the “free market” myth and the debunked belief that the ultra wealthy are somehow “superior humans.” To that I replied:

The rich too often get rich by exploiting the labor of others, not from doing the work themselves. The more others they exploit, , and the more they get from each of them, the richer they get. It’s basic math and superior resources and opportunity, not superior intellect, education, or work ethic.

In general, the performance and compensation of a first line manager with 15 employees paid less than what they contribute is greater than a manager with just 10 employees paid fairly. A director with 150 workers under him makes even more, a VP with a 1500 organization makes more still, and then there’s the CEO with thousands. Each employee contributes to the organization’s productivity and makes the manager, director, VP and CEO look good.

Executives also benefit from staff to manage their calendars, arrange meetings and travel, prepare their presentation and speeches, and even schedule their golfing and social events — all to make them look superior. But staff is never paid as much as they contribute. Such is the top-down nature of wealth.

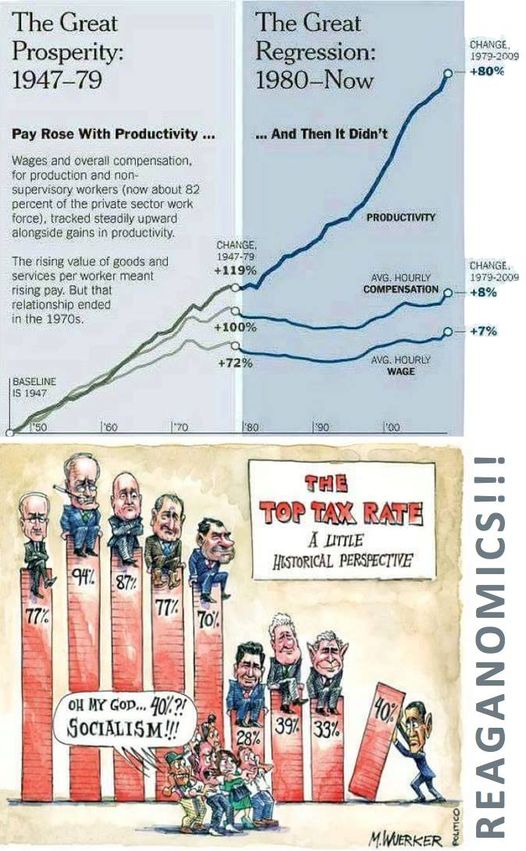

The idea of progressive tax rates that Reich supports is NOT a “far-left idea.” It was the longstanding American tradition until President Reagan’s promised a “trickle-down” economics.

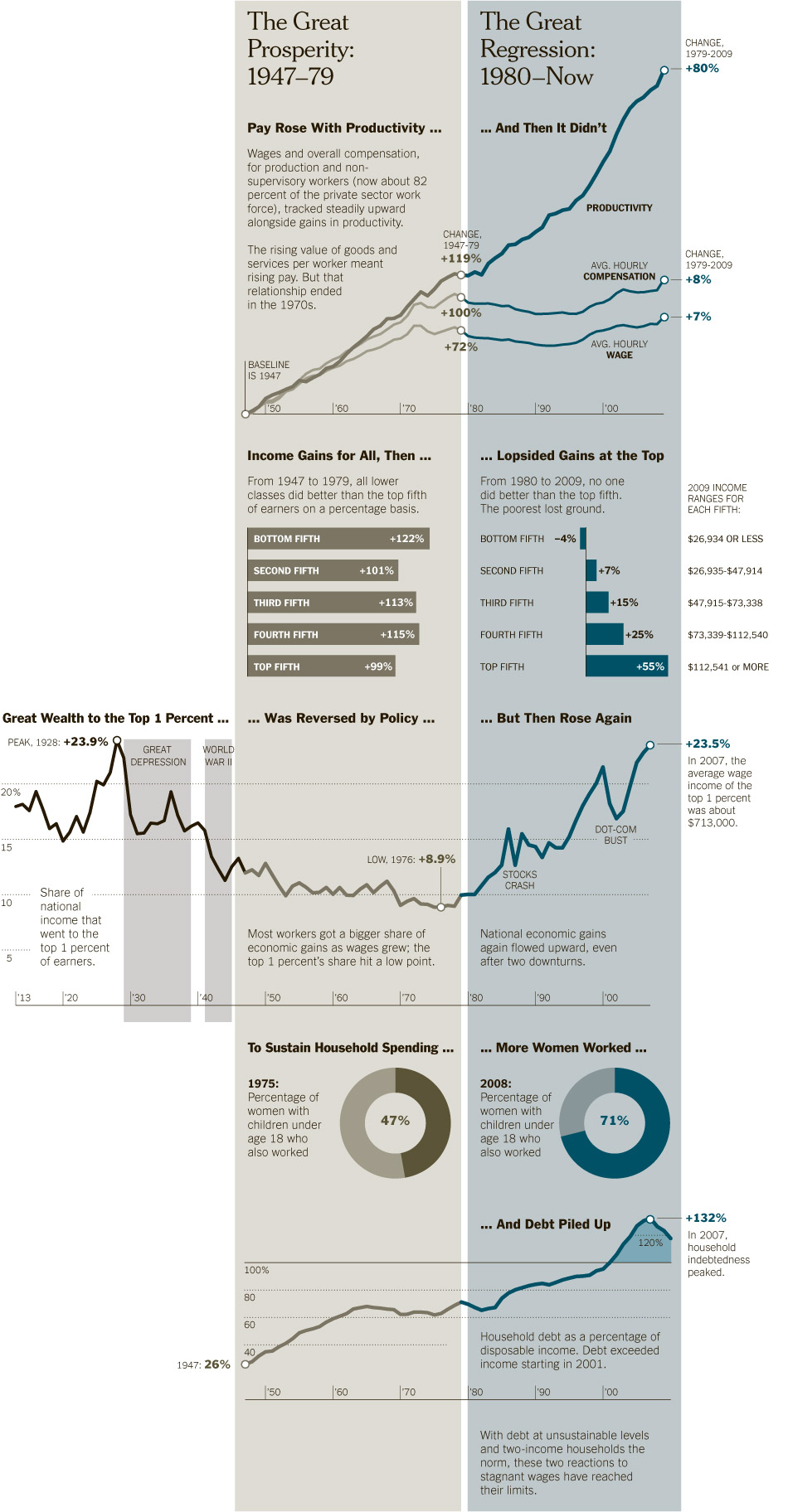

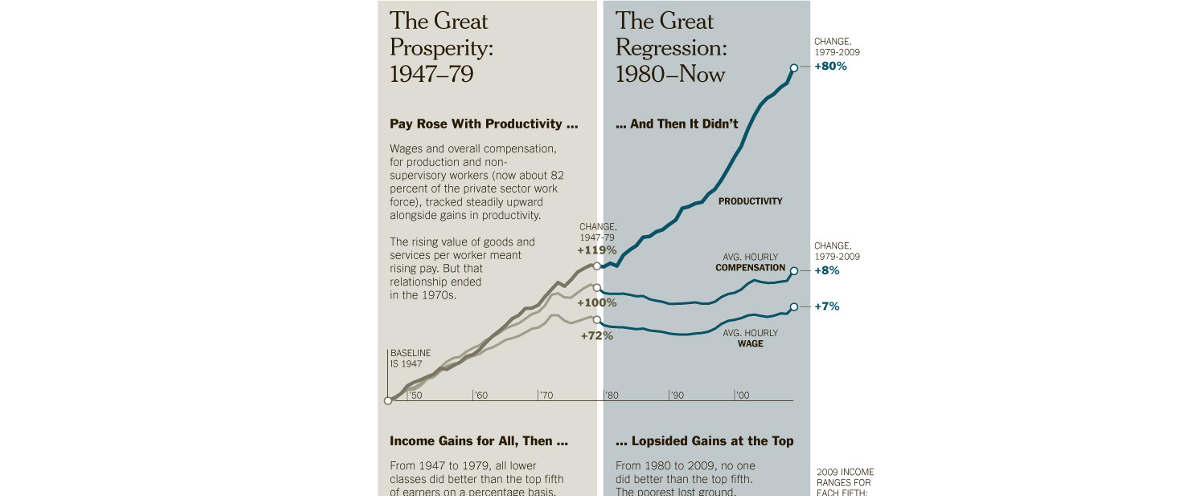

Great Prosperity and then Great Regression

The period after World War II saw great prosperity as wages tracked steadily upward along with productivity. The relatively high taxes were used to fund strategic investments in education, infrastructure, and economic growth. But then Ronald Reagan became president. He severely cut the top tax marginal rate with a promise of trickle-down economics. But that promise was never realized as worker compensation diverged from productivity.

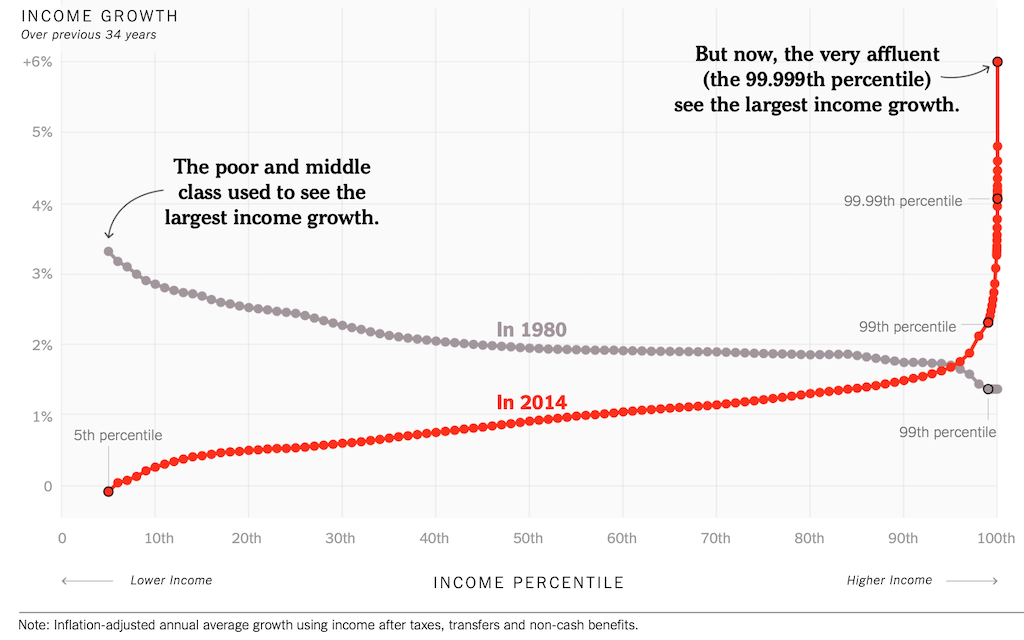

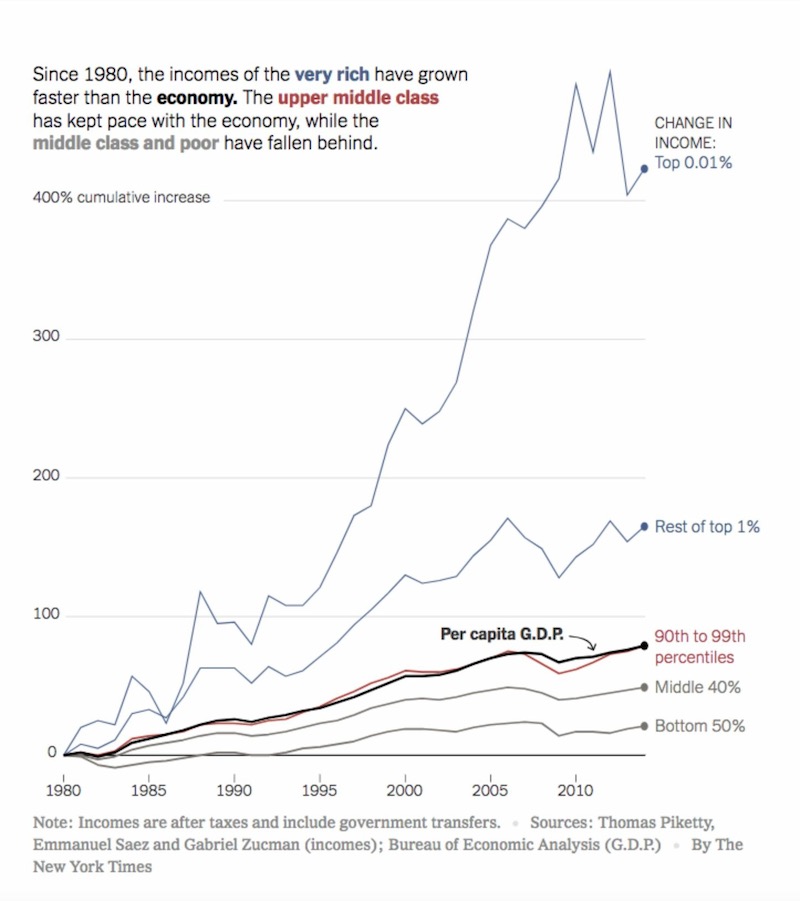

From 1946 through 1980, as represented in the grey line below, the poor and middle class used to see the largest annual income growth. But starting about 1980, seen in the red line, that shifted. Now, the most affluent (the top 0.1%) see the largest income growth.

TAX DEBATE: How Much Should We Tax the Rich?

This 16-min video above, produced by Patriotic Millionaires, argues there’s an easy way to save America from economic decline and political corruption. It uses real world examples to show just how badly our economic system is rigged against most of us. It covers tax advantages and loopholes for the rich but fails to explain why they exist in the first place. That, in my view, is largely due to unlimited spending on political influence, enabled and made worse by Citizens United, a disastrous Supreme Court decision. As I’ve argued here and elsewhere, the rich are able to use their extreme wealth to not just influence election outcomes and public policy but public opinion as well.

As shown in the documentary, The Brainwashing of My Dad, they have influenced public opinion through careful domination of news and social media. The film shows how voters can be made hateful, convinced to support radical policies, and vote against their own best interest. It has a storyline that chronicles grandpa’s severe change of personality when he got hooked on conservative talk radio and Fox News. Most surprising was how quickly grandpa returned to his friendly, fun-loving, and accepting self after his radio broke and grandma programmed their new TV without putting Fox on the favorites list. Grandpa then started watching NPR, PBS, BBC News, and National Geographic instead.

Debating Both Sides — The longer 1.5 hr video below shows both sides of the tax reform debate, considering three factors: Fairness, Sufficiency, and Efficiency. In the end, only 30% of the audience agreed that the rich are already taxed enough, while 63% were convinced that the rich are NOT taxed enough compared to the rest of society. But note that this debate was held BEFORE Trump gave massive tax breaks to the rich.

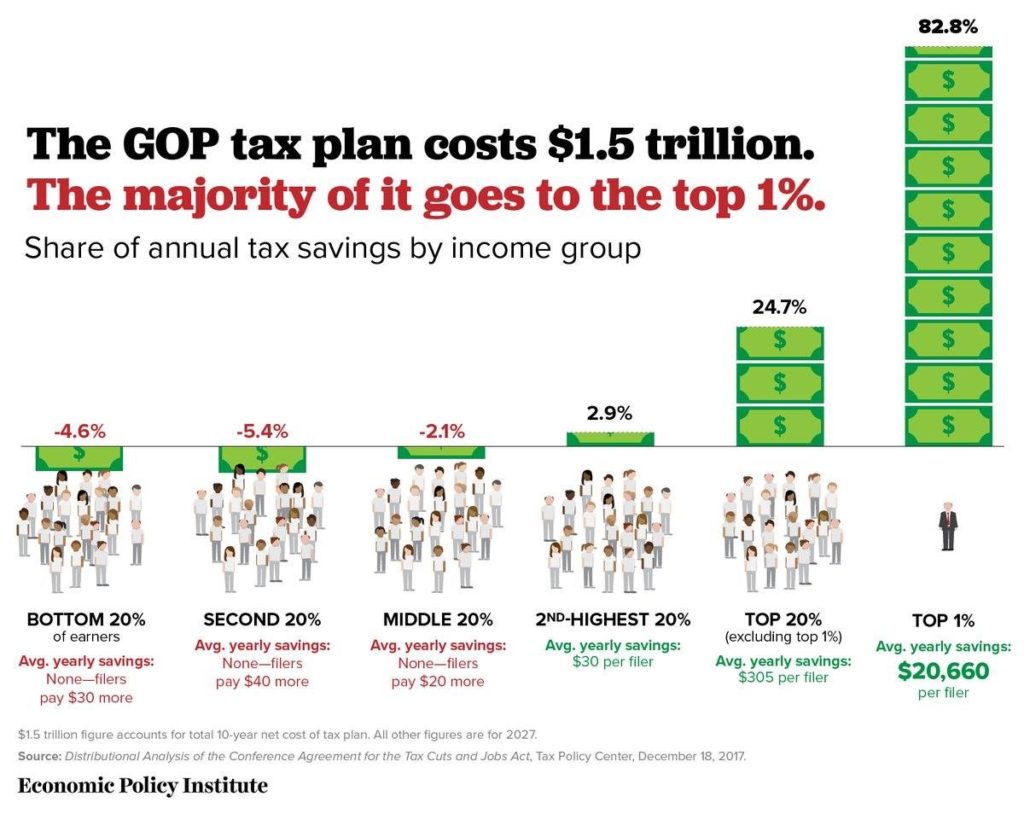

Historic Republican Tax Bill

President Trump’s tax bill is not the “incredible Christmas gift for hardworking Americans” that was promised. It’s an attack on income inequality, and according to the Economic Policy Institute, 60% of the nation will pay more taxes as health insurance rates spike, 13 million Americans lose all health insurance, and the top 1% gets over 80% of the tax benefit. This seems more like a massive tax scam than tax relief for the middle class. It will exacerbate political, wealth and income inequality and add over $1 trillion to the national debt. (Watch the videos and see the stats and bill analysis below).

Already, a whopping 62% of jobs don’t support middle-class life after accounting for cost of living, according to USA Today. And they aren’t saving, because they’re living paycheck-to-paycheck, with rising healthcare costs eating into any hope they have for financial stability.

Bill Analysis

Aine Cain wrote an article in Business Insider about what the Trump tax plan means for people at every income level, from $20,000 to $269,000 a year. But it is grossly misleading for many reasons, including:

1. This tax bill is not the “incredible Christmas gift for hardworking Americans” that President Trump promised, and the Senate’s version gave 62% of the benefits to the top 1% even though Trump said earlier that the bill would cost him “a fortune.” Public knowledge of that lie is why this bill is so historic –the most unpopular piece of legislation in over 30 years, according to Rachael Maddow.

2. The bill got much worse during the two weeks that the Conference Committee took to resolve House & Senate differences, because complicated provisions were added for pass-through companies in the real estate industry. It now gives 83% of the benefits to the top 1%, and the Trump family itself will save more than $1 billion.

3. While corporate tax cuts are permanent, the cuts shown are temporary, and so are the standard deduction increases. Congress cannot be trusted to keep the new rates in 10 years when they are set to expire, and by then the bottom 60% of the nation will pay MORE taxes under this plan.

4. The standard deduction is doubled, but gone are deductions for medical expenses, state taxes, property tax (impacts home buying & school funding), mortgage interest, student loans, and losses from fire & earthquake.

5. Health insurance premiums will spike by an estimated 10% or more because repeal of the insurance mandate will change the makeup of the insurance pool. With average U.S. healthcare costs already about $10K/year/person, that means you’ll spend about $1,000 more, offsetting any tax savings you expect.

6. An estimated 13M will lose all health insurance over the next 10 years, but that number could go up as high deficits trigger automatic costs to Medicare and Medicaid and cause more people to drop insurance, forcing them to wait until health conditions worsen and then rely on the ER. Social Security is not safe from cuts either under these conditions, and Republicans have already signaled that that’s their aim.

7. Corporate tax savings are supposed to trickle-down and increase hiring and wages, but that’s a pipe dream because wages have remained stagnant for 30 years. Corporations flush with cash from record profits have instead increased CEO compensation, bought back shares, acquired competitors, and stashed the rest in offshore accounts.

8. Changes in depreciation schedules, which allow investments to be written off 100% in the first year, will encourage more job-killing automation. Companies will be able to write-off the cost of robots and artificial intelligence, but not people; and after the first year, those assets are essentially free. Your salary and benefits aren’t.

9. Income from capital investments, including the stock market, are taxed at much lower rates than income from physical & mental “labor;” and that trend is accelerating. So to fund government as jobs disappear, maybe we should tax the robots, and all forms of income, equally, or make the tax code more progressive, but that’s the opposite of what Republicans are doing.

10. Wide income gaps preceded the Great Depression in the 1930s and Great Recession before Obama took office. This regressive tax bill will make the income and wealth gaps much wider and exacerbate the inequality problem described in this article.

Growth Doesn’t Trickle Down, It Rises Up

Growth Doesn’t Trickle Down, It Rises Up

These three charts show how “trickle down” economics has worked over the last 40 years — POORLY. The U.S. now has one of the highest levels of income inequality in the world.

The wealth gap is even worse, with the top 1% owning more of the nation’s wealth than the bottom 90% combined.

As corporations pay less in taxes, less revenue is available to fund public schools & colleges, public safety programs, and public utilities and infrastructure improvements. That trend is short-sighted in my view, because this hurts the engines of economic growth. Also, workers who keep paying more in taxes are a key pillar of the US economy. The payroll taxes that the government collects from our wages sustains both Social Security and Medicare. (from Markets Insider, 12/13/19)

TED Talk — “As taxes on the rich go up, job creation goes down.”

Nick Hanauer is a billionaire, unrepentant venture capitalist, and member of the 0.001%. He has something important to say to fellow plutocrats in this Ted Talk: Wake up! Growth doesn’t trickle down; it rises up.

Nick’s message is similar to that of Robert Reich. The only way to grow the economy is by investing in the education, health care and infrastructure that average Americans need to be more productive. These more productive workers then justify higher wages, and with higher wages, they purchase more goods and services.

Increased market demand is what motivates companies to expand and invest, and to create more and better jobs. The Trump-Republican tax overhaul is taking us in the opposite direction. It cuts health care, raises taxes on the middle class, reduces their purchasing power, and dampens growth. The multi-trillion dollar tax windfall enjoyed by wealthy corporations is not being invested in workers or automation to increase productivity, because there’s no need without demand. The savings instead is being used to buy-back shares or acquire competitors, thus enriching shareholders in a way that’s harmful to economic growth.

As one of the first advocates of a $15 minimum wage, Hanauer often speaks to other executives about the importance of public education, gun violence protection, a sustainable and healthy middle class, and the future of work in a 21st century economy. Given his extreme wealth, one might think he’d be a conservative Republican, but Hanauer is actually one of the most passionate and articulate economic communicators in the progressive sphere. His latest 17-minute 2019 TED talk is on The Dirty Secret of Capitalism.

EXTREME INEQUALITY & LARGE CORPORATIONS

Two recent reports show that power and money are concentrated in the hands of wealthy corporate executives and shareholders by way of record profits, massive stock buyback programs, low worker wages, exorbitant CEO pay, tax avoidance schemes, and formidable lobbying campaigns.

The reports only cover a few of the shady corporate practices, which include wage theft, union-busting, greedflation, skimpflation, and shrinkflation.

“When corporations hoard the profits resulting from workers’ increased productivity, it becomes a dangerous problem for the economy and our democracy,” according to The Patriotic Millionaires newsletter (3/20/24), which summarized the two reports.

As private equity buys up housing at record rates, housing costs skyrocket. And, as private equity invests $100 billion a year in health care, costs explode. Why don’t we hear about this fleecing of America? Hedge funds and private equity firms also are buying up half the nation’s daily papers, and reporters are being laid off in droves.

See the pattern? https://youtu.be/DaSn0iqzVv4 (5-min Robert Reich video)

HOW TO FIX ECONOMIC INEQUALITY? — This excellent and detailed report provides an overview of policies for the United States and other high-income economies

Some selected quotes:

“Inequality may hurt a country’s economy.

Recent studies find evidence that inequality hampers a country’s growth, and this view is gaining ground among policymakers.”

“The American Dream is fading.

Generations today are much less likely to earn more than their parents. Social mobility—the chance to move up the income ladder—has fallen in the United States. Americans are increasingly stuck in the income bracket they were born into.”

“The US federal minimum wage has fallen.

The US federal minimum wage, currently $7.25 an hour, has dropped by almost 30 percent since the 1960s when adjusted for inflation. More than half of US states have set higher minimum wages but the rest have not. [By contrast…] France’s minimum wage grew more than 80 percent between 1980 and 2016 when adjusted for inflation, to almost €10 or nearly $12 an hour.”

“The United States faces a range of crises: a continuing pandemic, widespread unemployment and business failures, climate change, racial and political polarization, and economic inequality. As the world attempts to heal from the damage inflicted by COVID-19, policymakers can use this moment to rebuild more equal and just economies that work for the many, not just the few.”

“Healthcare in the United States is not universal.

The United States is the only wealthy nation without universal health coverage. Healthcare expenditures grew from 5 percent of GDP in 1960 to almost 18 percent in 2018. Americans spend more than double on healthcare per person than other wealthy countries on average, many of which have some form of publicly funded healthcare system, yet the country lags on many health outcomes such as life expectancy and infant mortality.”

“Coronavirus Impact.

In addition to costing numerous lives and infecting tens of millions, the COVID-19 pandemic has triggered an unprecedented global recession, worsening underlying social vulnerabilities that contribute to inequality. … [Key observations:]

* Low-wage workers lost a higher share of jobs than high-wage workers. …

* Lack of healthcare and sick leave, and crowded housing conditions, spurred disease spread and death. …

* Minorities suffered the worst health and economic outcomes. …

* Those lacking college degrees were more likely to be exposed to the virus. …

* Working mothers bore the brunt of lost childcare [and suffered the most job loss].”

UNIVERSAL BASIC INCOME (from MadLori)

When discussing Universal Basic Income, inevitably the retort comes: “So you just want to not have to work, is that it?” accompanied by a smug smirk, expecting me to backpedal and hem and haw.“ Of course not, that’s silly. Except… yes. Yes I do.

People shouldn’t HAVE to work. People should WANT to work. Sharing in the labor of building and maintaining a society because it benefits everyone should be desirable, not forced. It shouldn’t be something we do because we’ll die otherwise.

Imagine a society where survival didn’t depend on a job. Imagine how that would alter the fabric of … everything. Imagine if you could leave a job without fearing the loss of income or health care. Imagine the power of the worker in that society.

If a person could survive without aq job, imagine what employers would be like. They’d have to treat their workers fairly and make themselves attractive to entice workers. They’d have to offer a better option than other employers, and make people want to participate.

Places that have offered UBI have seen the results: most people do want to work. The people who choose not to are generally young parents, students, people with disabilities, and the elderly. People have a desire to contribute, for our lives to have purpose and to be useful.

And before you say it, yes, some people will take advantage. That is true for absolutely everything ever. You think people don’t take advantage of the economy we have? Like, say, the 1% who grow wealthier while their employees have to work three jobs and use food stamps?

They can only do that, by the way, because people are so terrified of losing a job and the destruction that would follow that they tolerate mistreatment, disempowerment, the destruction of their unions, healthcare, retirements, and even their bodies to avoid it.

That would not be the case if everyone were guaranteed a baseline survival income. Your boss couldn’t treat you like shit because he knows you can’t leave. You CAN leave, and you will.

What if desperation didn’t motivate everything? Imagine the impact on health, relationships, parenting, well-being, crime, violence, progress. When you aren’t desperately scrabbling for the rent, you can spare a neuron to contemplate long-term problems.

Imagine a society where terror of destitution wasn’t a constant thrum underneath everyone’s existence. Imagine the creative works that society could produce. Imagine the children it could raise, the elderly it could care for. Imagine the inventions it could produce.

Now, imagine knowing all this and thinking, “NOPE. We can’t have all that, because someone I don’t like might benefit from it. So, to avoid that, the rest of you can all hang.” And there you have modern conservative thinking.

THE POPULISM PUZZLE: What caused the uprising that has transformed global politics?

MY ANALYSIS – In this rather disjointed article, academic economist Hal Weisman confuses Populism and Nationalism (the opposite of Globalism) in a sometimes-confusing attempt to explain partisan politics using extreme inequality and economic theories that don’t fit traditional models.

POINTLESS – The author seems to shy away from making any reasoned conclusions of his own but instead quotes many other economic researchers. This one quote, however, captures my overall reaction to this largely pointless article:

“I don’t think economists are the people to be asking about populism. The people who have said really smart things are the political scientists and sociologists.”

I certainly agree and am more aligned with the thinking of Robert Reich and George Lakoff. Reich, as former Labor Secretary under President Clinton, best understands the issue Extreme Inequality, but that alone does not explain why Trump’s base would vote against their best interests economically. They’ve been duped by a master salesman, and by decades of misleading conservative framing and language with the purpose of giving marginalized voters an enemy to blame for their economic plight, and to distract from the real enemy. Conservatives offer voters several enemies to pick from: blacks & Hispanics, other immigrants, the changing role of women, non-Christians, public schools and universities teaching liberalism, the mainstream media, and more. It’s my view that conservative politicians use conspiracy theories and disinformation campaigns as tools to reinforce a false narrative for the purpose of maintaining political power in the face of changing demographics.

Lakoff helps us understand the importance of framing and language so we can better communicate across political party lines. He comes at the issue from the perspective of a linguist, describing the different worldviews of Conservatives and Liberals. Conservatives tend to have a “Strict Father” moral hierarchy that puts Men over women, Adults over children, Whites over blacks, Christians over non-Christians, Straights over gays, the Wealthy over the poor, and so on. By contrast, Democrats tend to have a “Nurturing” perspective of morality that longs for a government OF, BY, and FOR the People – all people.

EXTREME INEQUALITY

Weisman spends quite a lot of time discussing inequality but struggled to connect it with Trump’s base. More important than income or wealth inequality is the concept of Fairness, or lack of it, as a cause the Populist movements he writes about.

It’s one thing to admire success from someone who worked hard for it, but it’s quite another to see them living lavish and opulent lifestyles off of inherited wealth or that coming from capital investments while simultaneously investing in political influence to keep others down. It seems grossly unfair and immoral for companies like Amazon and Walmart to make billions in profit but pay no taxes or even get tax credits. And it’s doubly unfair to middleclass when companies like Walmart pay poverty wages that leave workers relying on tax-funded public assistance programs for basic survival. One should not have to work 2-3 jobs and still struggle to support a family.

I too write about Extreme Inequality (see https://mHealthTalk.com/inequality/), but I don’t see it as a cause of partisanship. I see it as an antidote, because the vast majority of Republicans and Democrats alike have the same distrust of Washington elites and wealthy capitalists who exploit and distort laws in their favor. With that in mind, I add these top-line statistics for context.

• The richest 1% now own more wealth than the bottom 90% combined (the entire middle class). That’s $34.73T versus $32.80T (Federal Reserve stats for 2Q2019).

• The top 1% own more corporate equity and mutual fund shares than the bottom 99% combined. That’s $13.73T versus $32.80T.

• The bottom 50% lives hand-to-mouth and own less than 0.5% of stocks. They don’t invest and have no retirement savings.

• Many CEOs now make almost 1,000 times more than the average worker in their company. The Average worker needs to work more than 2 months to make what the CEO makes in just one Hour.

• Inequality is worsening. The top 1% have been replaced by the top 0.1% and 0.01%.

• The three richest Americans ― Bill Gates, Jeff Bezos and Warren Buffett ― now have the wealth of the bottom half of the U.S. population, or 160 million Americans.

MY NOTES FROM THE ARTICLE (much of it cut/pasted)

A 2018 survey found that 65% of people trusted doctors, 29% trusted economists, 19% trusted lawyers, and just 5% trusted politicians. More than 89% thought Washington politicians worked to enrich themselves and their largest campaign contributors, instead of working for the benefit of the majority of citizens.

“Capitalism inevitably leads to some inequality, which is tolerated by society to the extent that its benefits are clear and the inequality itself is seen to be relatively fair. Making the benefits clear requires economic growth that is distributed across society, while the fairness requires opportunities for economic mobility.”

The haves, possessing skills that are increasingly rewarded by the economy, can shape the political system to their benefit. The have-nots, with stagnating incomes, feel that the economy and the political system have been rigged to keep them out.

People’s tolerance for inequality has dropped, and there’s a rise in the US of “deaths of despair”—by drugs, alcohol, and suicide. But this doesn’t explain political polarization in the way that we have now. The persistence of this long-held resentment has transformed populism from a fringe protest movement to a mainstream political force.

Economic forces, especially automation and trade competition, can explain Populism. These have combined to create devastating job losses in some communities, particularly of middle-income jobs held by people without a college education. When manufacturing is automated or moved offshore, for example, you lose your job as a factory worker, but can still get reemployed in a Laundromat or as a security guard. It’s a lousier job, but at least there’s a job. In a smaller town, however, when the big employer leaves, the Laundromat also closes down.

[ME: While this explains the rise in Populism and distrust of Washington elites, it does not explain the political polarization. Both Trump and Sanders ran Populist campaigns in 2016, but while Trump was an authoritarian populist promising to use his “outsider” status and wealth (i.e. can’t be bought) to fight for middle income families, but he lied and continues to do so. Sanders was more of a reform populist, proposing major restructuring and redistribution of wealth, essentially punishing the wealthy for their success.]

“In both the US and the UK, populist leaders have cast themselves as warriors against political elites. President Trump, who originally ran on a “Drain the Swamp” platform, has repeatedly attacked Congress, the judiciary, the Federal Bureau of Investigation, and what he calls the deep state more generally.”

[ME: One way elites have failed is by neglecting to construct sufficient social safety nets, such as making strategic public investments in engines of growth, such as job retraining programs, public education & college, healthcare, infrastructure, and the environment, especially if fairly funded by more-progressive tax policies.]

[ME: These are the sorts of social reforms proposed by Bernie Sanders, another populist, that set him apart from Joe Biden, who many consider as too elitist and tied to the DNC powerbase. Sanders brings in fresh perspectives from those who feel marginalized, while Biden and other out-of-touch elites seem to have underestimated the difficulties faced by the rest of the population.]

Rising immigration is another possible explanation of the surge in populist politics in this last decade. Famine, drought, civil wars, and organized crime have driven tens of millions of people to leave poor and conflict-ridden countries in recent decades, many of them bound for Europe and the US. Immigration motivated many supporters of Brexit and President Trump, especially among those who tie immigration to their lack of opportunities. But immigration may have been a false enemy, since technology and automation have had a greater impact on the stagnation of the middle class. Populist politicians can more easily put a face on immigration than on machines.

The largest employers in each US state (mapped) Walmart has the most in 22 states.

Why You Shouldn’t Believe Those G.D.P. Numbers (NY Times, 12/15/19) with great interactive charts. MY SUMMARY:

WATCH 4 DECADES OF INEQUALITY DRIVE AMERICAN CITIES APART (NYTimes, 12/2/2019) I commented:

Study Shows Income Gap Between Rich and Poor Keeps Growing, With Deadly Effects (NY Times, 9/10/2019)

MY COMMENT: According to the HBO documentary series, The Weight of the Nation, public health officials can accurately predict obesity and longevity rates by zip codes. They’ve even seen average lifespan differences of more than 20 years between poor and affluent neighborhoods on opposite sides of the same city.

Disadvantaged communities are at higher risk for many preventable health conditions, including obesity, diabetes, heart disease, asthma, HIV/AIDS, viral hepatitis B and C, and infant mortality. That’s partially due to the lack of affordable healthcare, fresh and nutritious food, and the lack of sidewalks and parks that encourage exercise.

Political Genocide? It’s easy to think these extreme longevity differences are intentional. After all, dead people don’t vote, and neither do the disproportionately black victims of mass incarceration. These disgusting and effective voter suppression techniques are discussed with others in Politics, Voter Suppression, and Modern Killing Fields.

For the sake of life on Earth, we must put a limit on wealth (The Guardian, 9/19/2019) This related article in The Guardian extends my concern with Extreme Inequality to the devastating effects it has on the environment and climate change, even if unintentional. It describes “the psychological impacts of being wealthy. Plenty of studies show that the richer you are, the less you are able to connect with other people. Wealth suppresses empathy.” It also suppresses concern for the planet.

President Donald Trump’s War On The Poor. Cruelly, the Trump response to record poverty is to make it worse.

Think Wage Inequality is Bad? Benefit Inequality, including healthcare, is Worse. WHY? (7/23/2020) The authors attribute benefit inequality to the decline of unions and the increase in nonstandard employment practices. Classifying workers as contractors, temporary, or part-time lets employers avoid paying for healthcare, retirement, or paid leave. In other countries, the government pays these expenses.This form of inequality is especially bad during a pandemic when so many of the “essential workers” lack these benefits. It makes the public health problem, and the economic problem, so much worse.

It Is Expensive to Be Poor – Minimum-wage jobs are physically demanding, have unpredictable schedules, and pay so meagerly that workers can’t save up enough to move on.

Understanding The U.S. Economy: Lots Of Rotten Jobs (Forbes, 12/6/19) “When U.S. unemployment is at a 50-year low, why do so many people have trouble finding work with decent pay and adequate predictable hours? A new economic indicator—the US Private Sector Job Quality Index (JQI)—gives the answer: we have lots of jobs, but they are increasingly low-quality jobs.”

CEO who slashed his salary to give employees a raise shares more good news (TODAY, October 2019) Dan Price, the CEO of Gravity Payments, announced employees in a new Idaho office will receive a minimum $50,000 salary and committed to pay everyone at least $70,000 by 2024.

The gig is up: America’s booming economy is built on hollow promises

COMMENT: I learned the pros & cons of contract work firsthand, after retiring from my 30-year IBM career and starting an independent consulting firm. I had it much better than most, because my IBM pension reduced retirement worries, and IBM also covered my healthcare, but income from contract work was spotty. After each gig was over, it was like starting all over, because while on contract, I wasn’t going to conferences or classes to maintain the skills and contacts that made me valuable in the first place.

Robert Reich is right to criticize corporations exploiting contract workers. I saw exploitation too. At one point after IBM, I worked as Dell’s worldwide PC messaging manager until the company outsourced the entire department. Just a week later, a headhunter called to offer me a temp job – doing the exact same thing I did before, but with half the pay, no benefits, and no job guarantee. I turned it down, but that’s what workers face today. Those working for companies like Uber don’t even have retirement or healthcare benefits. They’re screwed, but so are we. Our taxes will help fund the social services needed to keep them alive. And who profits from this?

Robert Reich on Why We Need to Break Up Big Tech (5:14 video) I commented…

20/20 FORESIGHT – The threat of antitrust actions and progressive healthcare reforms suggest 2020 will be the most expensive political campaign ever, and by a long shot. These large companies and industries have much to lose, and the Trump tax cuts taught them that investing in political influence delivers huge returns. There’s likely no other investment they can make that comes anywhere close. So it’s not too far fetched to imagine 2020 as the first multi-billion dollar election, even approaching a trillion. Follow the link for justification.

Medical Tourism is a good example where there’s no correlation between cost and quality. In fact, having knee-replacement surgery in a specialized clinic in Costa Rico or Malaysia can not only cost far less than that hospital across town, even with travel. It can also have far better outcomes, because these clinics are run like a factory and have become extremely efficient. Surgery and recovery are both quicker, and because they see so many clients, they likely have seen many more complications, and are thus more prepared for them. Unlike U.S. hospitals, they can even quote you a price ahead of time.

America’s Real Economy: It Isn’t Booming (Forbes)

NYTimes: CEO’s should fear a recession — it could mean a revolution. (8/22/19) SUMARY…

A revolution in Chile sparked by U.S.-style economics. Our billionaires should be very worried. (Inquirer, October 2019) I commented about advantages billionaires have here that they don’t have in Chile.

Why CEOs Actually Deserve Their Gazillion-Dollar Salaries (Apple News, April 2019)

USA ranked 27th in the world in education and healthcare—down from 6th in 1990 (BigThink) America continues to tread water in healthcare and education while other countries have enacted reforms to great effect.

A.I. Will Enable You To Find Purpose In Life Instead Of Just Flipping Burgers All Day — I agree with almost all of the ideas in this interview with Martin Ford, Futurist, Speaker, A.I. Expert. Here are some additional thoughts I’d add:

The Top Most Profitable Industries And Their Impact On Low-Income People (FORBES, 2/19/2019)

As I think about what’s behind the zero-taxes paid by immensely profitable companies like Amazon, Walmart and GE, it seems that we are miscalculating Profit. Isn’t Profit supposed to be Revenue minus Expenses? When did it become Revenue minus Expenses minus Investments in growth?

So now think of how the rest of us pay taxes. It begins with the W2 (wages minus tax withholdings). But imagine if regular workers could deduct “expenses” of working and investments to advance their career or earning capacity.

EXPENSES: child care, car payments or purchase (amortized in one year), gasoline and maintenance, including car wash and detail, apartment or home rental or purchase (because being homeless is a drain on earning potential), healthcare and nutrition and exercise to maintain work productivity and broaden business contacts (including golf health club memberships), fees paid for legal and financial services, etc.

INVESTMENTS: Tuition, stock purchases, purchases of land and other assets (including rental property), computer equipment and phones and TVs (Isn’t that how we consume news and Info to keep us relevant?)

Now what if we could deduct all of these expenses and investments from OUR taxable income? We too could pay no taxes. And what if the (tax deductible) fees we pay to tax accounts, attorneys, and lobbyists were used to insert new deductions into the tax law for us? What new things might we want to deduct?

Why are millennials burned out? Capitalism (Vox) … This conversation is a good companion to my article on “Income Inequality, Healthcare, and the Economy.” (https://mHealthTalk.com/inequality/)

The challenge is not just that our economic system lets fascists exploit workers who now work harder and are more productive even as wages stagnate and profits soar. These workers are increasingly responsible for their own skills development, healthcare, and retirement. But pensions have been replaced by 401-k shared contribution plans, fewer companies offer comprehensive health insurance, and college degrees lose value as the accelerating pace of tech innovation quickly obsoletes skills.

The situation is worsening as wealth inequality begets unequal political influence in a downward spiral. Billionaires have shown how easy it has become to buy elections and favorable legislation that protects their wealth and strengthens their competitive advantage. Such a system not only disadvantages workers but also entrepreneurs who find competing on an uneven playing field is every more difficult. My favorite example of that trend is captured in the documentary, “The Corporation.” (https://mHealthTalk.com/corporate-behavior/)

The healthcare industry is a notable failure of capitalism to create vibrant competition, improved costs and quality, and better wages and working conditions. Burnout among doctors and nurses has become a huge problem as the US spends twice as much on medical care as other advanced nations with better outcomes and longevity. But the medical industrial complex (or a medical cartel) has strong control of our politics (at least Republican politicians) and is doing all they can to avoid effective reforms that could save over $1.5 trillion/year. Such reforms would mean a loss of revenue and profit. This is why I’ve come to believe that you can’t fix our healthcare without first fixing our broken politics. And it’s discussed in my article, “Why American Healthcare is So Expensive.” (https://mHealthTalk.com/expensive/)

Lastly is my worry that our legislative process is historically slow by design and may not be able to cope with fast-paced societal changes due to AI, robotics, automation, and the blending of science and technology (Info + Nano + Bio + Neuro). (https://mHealthTalk.com/moores-law-and-the-future-of-healthcare/)

Survival of the richest: The wealthy are plotting to leave us behind (CNBC Technology) I found this incredibly thought-provoking article to be a perfect blend of two disturbing trends:

1. The Exponentially Accelerating Pace of Tech Innovation, which I hint at in Moore’s Law and the FUTURE of Healthcare, brings with it concerns over how humans will be able to control and govern whatever technology brings us.

2. The Widening Wealth Gap further brings with it the corrupting influence of big money in politics.

As the author shared his experience and thoughts from meeting with a handful of user-wealthy global oligarchs, I became more convinced that my own fears are more than justified. I’ve been writing for a while that the biggest problem I see is government’s inability to understand, regulate, and control markets and products resulting from tech innovation. Instead of speeding the process of lawmaking, it seems to have come to a halt and is even falling backwards in the name of conservatism and preserving “the good ole days.”

CEOs are dumping stock in their companies. Here’s what that means (CNN 7/17/2018) — Stock buybacks are deepening income inequality. But, Isn’t Stock Manipulation and Insider Trading already against the law? Each CEO should be charged, convicted, and jailed.

Why is the 1% So White? (5:50 min video) Out of 536 billionaires in the USA, only 3 are black. Why the stark racial divide? Well it’s complicated, but it turns out our history of racism has a lot to do with it. From segregated schools that receive less funding in property taxes, to the history of redlining black homeowners, to the long history of slavery, oppression, and segregation, white families were accumulating wealth. That “old money” has provided the capital for the modern-day billionaires, and even average-income white families, to stay significantly ahead of black Americans. So how can we fix the wealth divide in America? Franchesca “Chescaleigh” Ramsey addresses this in this week’s Season 2 throwback episode of MTV Decoded.

The Racial Wealth Gap: Why A Typical White Household Has 16 Times The Wealth Of A Black One (Forbes)

Racist History in Banking (5:34 video) After centuries of racist banking policies and practices, for every $100 of white family wealth, black families only have about $5.04.

It’s Time to Get Billionaires Off of Welfare (TIME) Government programs for low-wage workers is a form of corporate welfare. A livable minimum wage would save taxpayers hundreds of billions.

What Billionaires Want: the Secret Influence of America’s 100 Richest (The Guardian) — A new study reveals how the wealthy engage in Stealth Politics: quietly advancing unpopular, inequality-exacerbating, highly conservative policies

The Dangerous Myth of Deregulation (3:42 min video by Robert Reich) Don’t fall for the conservative myth of deregulation. It is nothing more than another form of trickle-down economics – where the gains go the top, and nothing trickles down except risks and losses.

We’re Measuring the Economy All Wrong (NY Times) Ten years after the collapse of Lehman Brothers, the official economic statistics — the ones that fill news stories, television shows and presidential tweets — say that the American economy is fully recovered. The unemployment rate is lower than it was before the financial crisis began. The stock market has soared. GDP has risen 20 percent since Lehman collapsed. The crisis is over. But, of course, it isn’t over. And the main reason is inequality.

Texas Homebuilding and the Global Financial Collapse — I wrote this paper in 2009 as Communications Director of Homeowners of Texas. It describes the role Texas and large homebuilders played in the collapse and argues that our laws made the $35B Texas homebuilding industry a magnet for unscrupulous builders, including many from out-of-state. We allowed (and even encouraged) bad builders, substandard construction, and tort reform, thus destroying the life savings of countless Texans, causing the demise of entire subdivisions, and contributing to the economic collapse. We now find that substandard construction has plagued all segments of the Texas homebuilding industry.

Don’t be fooled [by AVERAGE income versus MEDIAN income and INFLATION rate]: Working Americans are worse off under Trump (Washington Post)

Study: American jobs aren’t supporting middle-class life — “Most Americans are unable to live a middle-class lifestyle, despite being employed, because their salaries won’t support it, according to a new study published in Third Way.”

Hourly pay to afford one-bedroom rent is more than double minimum wage (Business Insider)

The World Would Be a Better Place Without the Rich — ‘Interesting but rather long essay by Sam Pizziagati, who concludes, “They coarsen our culture, erode our economic future, and diminish our democracy. The ultra-rich have no redeeming social value.”

Disney Heiress Says She Will Benefit from GOP Tax Plan but Is Against It (Snopes) In a viral video, Abigail Disney said the 2017 tax plan is a windfall for rich people and large corporations while hurting ordinary working Americans.

The Monopolization of America — In one industry after another, big companies have become more dominant over the past 15 years. FAIRNESS is a good base for Dems to frame the issues of Inequality, Monopolies, Tax Policy, and Justice.

It’s surprisingly hard to give away billions of dollars — Even billionaires who want to give all their money away keep accumulating more. Here’s why.

How wealth inequality in the US affects health inequality in the US: 4 essential reads (I commented)

Politicians have caused a pay ‘collapse’ for the bottom 90 percent of workers (Washington Post)

The New Reality of Old Age in America (Washington Post) “I’m going to work until I die,” says one 74-year-old in a generation finding it too costly to retire.

A Wealth Tax Is Just What The Country Needs (FORBES 2/1/2019)

WHY are Republicans (and others) not fulfilling their oaths? In this MUST WATCH VIDEO, Alexandria Ocasio-Cortez explores that in her five-minute corruption game in front of the House Oversight Committee.

Michigan Blue Cross CEO’s $19.2M pay is higher than Ford, FCA bosses

Capitalism is failing workers. People want a job with a decent wage – why is that so hard? (The Guardian, 4/24/19) “Wage stagflation, inequality, soaring CEO pay, market monopolies and food banks – why are the fruits of capitalism distributed so unfairly? Why does capitalism work for the few, but not the many?”

The $100 trillion question: What to do about wealth? (Washington Post, 5/5/19)

China is not the source of our economic problems — corporate greed is (CNN, 5/26/19) “The real battle is not with China but with America’s own giant companies, many of which are raking in fortunes while failing to pay their own workers decent wages. America’s business leaders and the mega-rich push for tax cuts, more monopoly power and offshoring — anything to make a bigger profit — while rejecting any policies to make American society fairer.”

Six people who prove capitalism is broken in America (The Guardian, 5/2/2019) HEAR THEIR STORIES:

1. The Lyft driver who says she’s lucky to make $8 an hour, after expenses

2. The Amazon warehouse worker who lives out of her car

3. The Virginia boy who takes classes in plywood trailers while the state promises Amazon huge tax breaks

4. The Tesla factory worker who was told to keep working after his co-worker on the assembly line passed out from exhaustion

5. The single mother of two who works six days a week at a fast food restaurant, yet is homeless

6. The laid-off GM worker who feels cheated by Trump’s broken promises

Top charts of 2018 (Economic Policy Institute) These 12 charts show how policy could reduce inequality—but is making it worse instead.

Millions Of Jobs Have Been Lost To Automation. Economists Weigh In On What To Do About It (Forbes 6/15/2019) When it come to politics, the workers “most heavily impacted by automation and outsourcing tended to oust moderate congressional representatives in favor of more conservative or liberal ones.” They also vote in higher numbers, because they will be impacted more by the outcome.

How Baby Boomers Broke America, by Steven Brill (TIME 5/17/2019) This excellent article starts with, “HOW DID WE GET HERE? How did the world’s greatest democracy and economy become a land of crumbling roads, galloping income inequality, bitter polarization and dysfunctional government?”

Millennials may soon become the richest generation ever (Fox 10/31/2019) Nearly 45 million U.S. households will hand down about $68.4 trillion over the course of the next quarter-decade. These baby boomers, the richest generation in history, are aging and preparing to pass down their assets. This will exacerbate extreme inequality and public demands to tax wealth and unearned income (capital gains).

DREAM HOARDERS — In his new book, Brookings scholar Richard V. Reeves argues that the upper-middle class has enriched itself and harmed economic mobility. The top 20% are just as responsible as the 1%, he says, and should be a target of progressive tax rate increases. The higher you go up the income or wealth distribution, the bigger the gains made in the past three or four decades, and the more you should pay in effective taxes.

Why Do the Rich Have So Much Power? (NYTimes editorial by Paul Krugman, 7/1/20) Americans may be equal, but some are more equal than others.

These Companies Gave Their C.E.O.s Millions, Just Before Bankruptcy (NY Times, 6/23/20) Robert Reich commented:

Isn’t the real socialism the welfare benefits given to the rich? That’s what Robert Reich describes in this 3:10 min video. “Ever notice how nobody asks ‘how are you going to pay for it’ when we give massive government subsidies to Big Pharma, Big Oil, Big Tech, and defense contractors?”

How does your salary compare? Here’s how much money those 1 percenters really make (USA Today, I commented)

Trump’s Tax Scheme / Stock Buyback Bamboozle (2.4min whiteboard video) Robert Reich: “Remember how Trump and Republicans in Congress claimed corporate tax cuts would boost wages and grow the economy? Rubbish. Corporations are spending much of their savings from the tax cut on stock buybacks — plowing a record $178 billion into buying back shares of their own stock. Here’s how it works:”

CONGRATULATIONS! After the tax scam, you’ll be victimized, again.

(From Ken Sink, edited for visual effect)

The Republican calculation of available Social Security is flawed, because they neglected to factor in the people who died before they ever got a SS check. Where did that money go?

But the lie continues. … Remember that not only did you and I contribute to Social Security, but your employer did too. It totaled 15% of your income before taxes.

If you averaged only $30K/year over your working life, that would be close to $220,500. Read that again.

Did you see where the Government paid in one single penny? We are talking about the money YOU and your employer put in a government bank to insure you would have a retirement check from the money you put in, not the Government.

Now Republicans are calling that money “an entitlement” when you reach the age to take it back.

If you calculate the future invested value of $4,500 per year (yours & your employer’s contribution) at a simple 5% interest (less than what the Government pays on the money that it borrows), after 49 years of working you’d have $892,919.98.

If you took out only 3% per year, you’d receive $26,787.60 per year, and it would last better than 30 years (until you’re 95 if you retire at age 65) And that’s with no interest paid on that final amount on deposit!

If you bought an annuity that paid 4% per year, you’d have a lifetime income of $2,976.40 per month.

THAT’S WHAT REPUBLICANS HAVE PLANNED FOR YOU — A FAR BIGGER PONZI SCHEME THAN WHAT BERNIE MADOFF DID.

Entitlement my foot; I paid cash for my social security insurance! Just because the government borrowed the money for other spending purposes doesn’t make my benefits some kind of charity or handout!!

Remember these Congressional benefits — free healthcare, outrageous retirement packages, 67 paid holidays, three weeks paid vacation, unlimited paid sick days. Now that’s welfare, and they have the nerve to call my social security retirement payments entitlements?

Republicans call Social Security and Medicare an entitlement even though most of us have been paying for it all our working lives. And now, when it’s time for us to collect, they say the government is running out of money, even as they pass massive tax cuts for the wealthy by taxing the poor, denying them healthcare, increasing overall costs for the middle class, and adding over $1 trillion to the deficit.

Why did the government borrow from Social security in the first place? It was supposed to be in a locked box, not part of the general fund. Sad isn’t it? Also sad is that 99% of people reading this won’t have the guts to SHARE it.

Here’s the situation in the USA. (cut/paste from Jacob Santa with my minor edits)

We do not live in a democracy. We do not live in a republic. We live in a corporatocracy run by dynastic plutocratic families, corporate oligarchs, and international banksters, many of whom are zionists and/or members of secret societies, who are rooted in self-interest, greed, and power…not Love and Wisdom.

Even though they are merely a fraction of 1% of the population, they presently own at least 40% of the wealth here in the USA ($26 trillion). With their immense wealth, they dominate the politicians and the mainstream media and the financial system and the legal system and the corporations.

They get the politicians to pass laws that favor their agendas. They use the CIA, the FBI, the NSA, Homeland Security, the legal system, the police and the military to enforce their will. They use mainstream media, including movies and music, to program us from the cradle to the grave.

They foster religious, racial, ideological, etc divisions among the People. They have been wreaking havoc upon the People both here and around the world and Gaia Mother Earth for centuries.

From the holocaust of the Native Indians to present-day political genocide and the holocaust of the people of the Middle East, Central Asia and Africa, they are responsible for more deaths and unnecessary suffering of more men, women and children than any other group of individuals on earth.

RELATED ARTICLES:

The Shared Ingredients for a Wellbeing Economy (better than measuring GDP or stock price)

“A Wellbeing Economy matters. We currently have an economy that is producing social injustice and climate catastrophe by design. We need to move to a system that puts the economy at the service of people and the planet, not one that uses people and planet as fuel for rising stock prices and spiralling levels of wealth for those at the top. A growing number of the greatest thinkers and leaders of our time, from economists to environmentalists, politicians to protesters, are calling for this shift. Without it we will continue to face crisis after crisis.”

World’s richest 1% captured almost two-thirds of new wealth created in two years (1/17/2023)

“For every dollar of new global wealth earned by a person in the bottom 90% during the first two years of the COVID-19 pandemic, aq billionaire got $1.7 million. … A flood of public money pumped into the economy by rich countries during the pandemic, combined with tax policies that favor the wealthy, higher corporate profits, and rising prices, helped to fuel a surge in wealth for the world’s richest people. To reverse a trend of widening inequality, taxes must be raised on the richest people in the world, the organization said.” (Oxfam report issued during the World Economic Forum in Davos)

Nations where 3.3 billion people live spend more on debt than on health care, schools (AL JAZEERA, 7/13/23) “Almost half of humanity lives in countries that spend more servicing interest on debt than health or education.” Governments of poor countries, like the poor people in America, tend to pay much higher interest rates and suffer financial hardship as a result. It’s a direct result of greed from private investors who regularly exploit the misfortunes of others, and it’s widening a dangerous wealth gap that feeds on itself and corrupts political systems.

How Billionaires Secretly Influence Society (12/2/2001) In this RepresentUs video (1:32), Hasan Minhaj explains how dark money flows through nonprofits as legalized political corruption.

Ten Ways Billionaires Avoid Taxes on an Epic Scale (/6/24/2022) After a year of reporting on the tax machinations of the ultrawealthy, ProPublica spotlights the top tax-avoidance techniques that provide massive benefits to billionaires.

How Nancy Pelosi plans to address growing inequality (June 2021, Washington Post)

The Bill Jeff Bezos Doesn’t Want You To Know About (6/21/21) In this video (4:37), Robert Reich breaks down why Congress must pass the Protecting the Right to Organize Act and rein in the unchecked power of corporate behemoths like Amazon.

The Secret IRS Files (PROPUBLICA 6/8/2021) Never-before-seen Records Reveal Details of How the Wealthiest Avoid Income Tax. WHY they are publishing this.

How Billionaires Hide Their Assets: Lifting the Veil of the Wealth Defense Industry (5/26/2021)

A New Approach to Measuring Income Inequality Over Recent Decades (Rand Corporation) What’s missing from this report is a discussion of Wealth and the fact that so many American oligarchs pay no income taxes because they have no income. Their lavish lifestyle spending comes from borrowing on their accumulated wealth while the dollars keep piling up. And the interest becomes a tax credit.

Who’s Really Looting America A “must watch” 4:00 video by Robert Reich

How Corporations Crush the Working Class (4:26 Robert Reich video) Big corporations with monopoly power leave workers with fewer employment options for upward mobility and less salary negotiation power, even without the destruction of labor unions.

The Top 1% of Americans Have Taken $50 Trillion From the Bottom 90%—And That’s Made the U.S. Less Secure (TIME 9/14/2020)

American billionaires got $434 billion richer during the pandemic (CNBC, 5/21/20) “Amazon’s Jeff Bezos and Facebook’s Mark Zuckerberg had the biggest gains, with Bezos adding $34.6 billion to his wealth and Zuckerberg adding $25 billion”

The Rich Are Minting Money in the Pandemic Like Never Before (Bloomberg, 1/17/21) “You cannot have a sustainable economy and political system where you have a small population who believe they are invincible and a growing population who feel defeated. It’s in capitalism’s best interest to close this gap.”

World’s richest men added billions to their fortunes last year as others struggled (Washington Post, 1/1/2021) “Billionaires have added about $1 trillion to their total net worth since the pandemic began while others struggled.”

Here’s what $1 trillion looks like.

America Will Struggle After Coronavirus. These Charts Show Why. (NY Times, 4/10/20)

The Gap Between Rich And Poor Americans’ Health Is Widening (NPR 6/28/19)

Analysis Shows Top 1% Gained $21 Trillion in Wealth Since 1989 While Bottom Half Lost $900 Billion (Common Dreams, 6/14/2019)

The Economic Consequences of Major Tax Cuts for the Rich (December 2020 white paper by The London School of Economics & Political Science) “Major tax cuts for the rich since the 1980s have increased income inequality, with all the problems that brings, without any offsetting gains in economic performance.”

VIDEO: Robert Reich on Trump’s Betrayal of the Working Class (3:15 min) Former Labor Secretary Robert Reich explains how Trump has broken his promises to American workers, and the impact.

Why Trump Still Has Millions of Americans in His Grip (NYTimes, 5/5/2021) Many white Americans have felt sidelined by deindustrialization and economic trends that have stagnated wages. Meanwhile, Liberal onlookers observing right-wing populism accuse adversaries of racism and sexism. Where there is plenty of truth in that view, it’s not the whole story. This article dives deeper and includes my highlights and comments.

Trump’s ‘cruel’ measures pushing US inequality to dangerous level, UN warns (The Guardian) “Can you believe a country where the life expectancy is already in decline, particularly among those whose income is limited, giving tax breaks to billionaires and corporations while leaving millions of Americans without health insurance?”

Survival of the richest: The wealthy are plotting to leave us behind (CNBC) I found this incredibly thought-provoking article to be an overlap of two disturbing trends with implications for healthcare and humanity: (1) the Exponentially Accelerating Pace of Tech Innovation, with concerns over how humans will be able to control and govern whatever technology brings us, AND (2) the Widening Wealth Gap, which worsens the corrupting influence of big money in politics.

Twelve charts of 2018 that show how policy could reduce inequality—but is making it worse instead (Economic Policy Institute) While low unemployment is good news, it doesn’t tell the whole story of how typical families are faring in the current economy.

Who’s More Likely to Be Audited: A Person Making $20,000 — or $400,000? — “If you claim the earned income tax credit, whose average recipient makes less than $20,000 a year, you’re more likely to face IRS scrutiny than someone making twenty times as much. How a benefit for the working poor was turned against them.”

Historically, Income Inequality Is Known As A Destroyer Of Civilizations (The Intellectualist)

The Coming Collapse (Disturbing Essay) “It is impossible for any doomed population to grasp how fragile the decayed financial, social and political system is on the eve of implosion.”

Capital in the Twenty-First Century (book by Thomas Piketty) The central thesis is that inequality and inherited wealth is a natural result of capitalism, and that the very democratic order will be threatened unless inequality is kept in check through state interventionism, including progressive taxation.

How rich are the rich? If only you knew (I commented)

Forty-two people hold the same wealth as half the world, Oxfam says

The 1% grabbed 82% of all wealth created in 2017 (Oxfam says)

Study: Billionaires Could End Extreme Poverty 7 Times Over (TIME)

If the poor must work to earn every dollar, shouldn’t the rich? (The Washington Post)

AI will spell the End of Capitalism (Washington Post) I share this concern, especially since public policy is not keeping up with tech innovation.

United Nations journey finds that America is a land of both Great Wealth and EXTREME POVERTY (The Guardian)